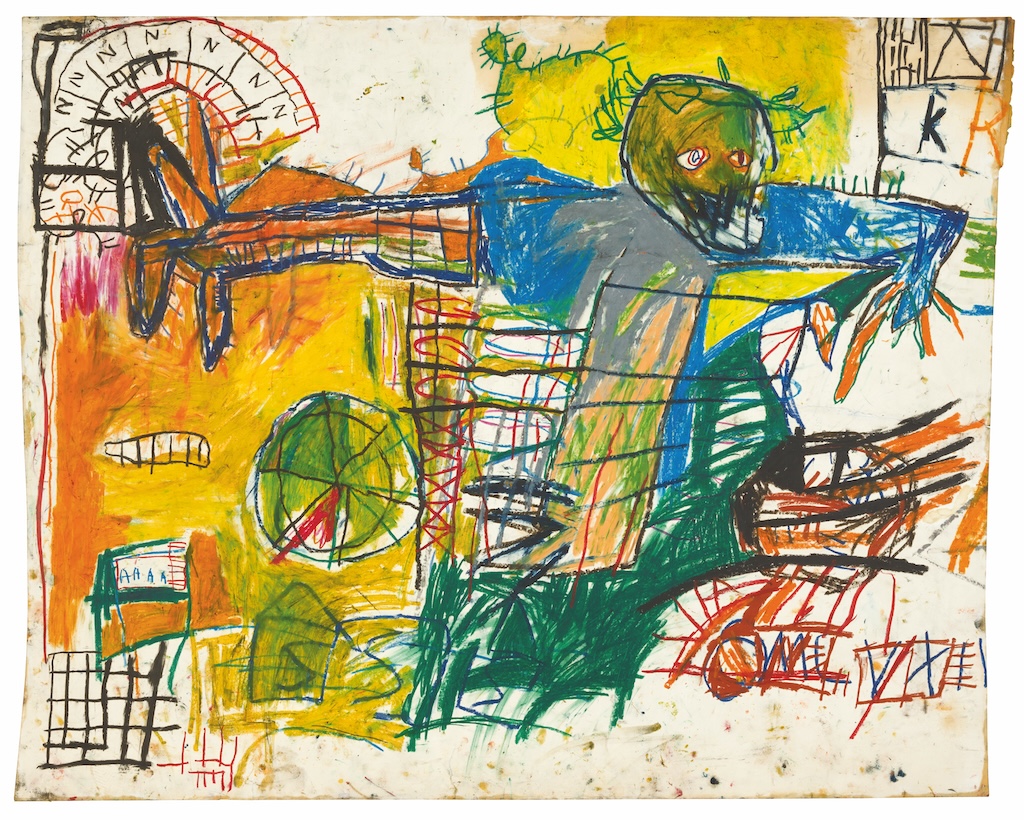

If 2024 is a projected year for the art market, 2025 will certainly be a year of combined details.

In a brand-new record launched today Art Market Trends 2025 Online Artsy carried out a study of greater than 384 gallery experts and art dealerships in 60 nations. Greater than 75% of participants check out financial unpredictability as a significant obstacle, while 60% shared worries concerning dropping enthusiast habits and need.

However while the gallery states they intend to bring in young and novice collection agencies, their methods suggest an absence of implementation or feasible dedication. 43% claimed they intend to make even more financial investments in on the internet sales this year, while just 19% explained themselves as leaders taking on brand-new modern technologies. At the same time, majority claimed they did not enhance openness in 2014.

Art Market Trends 2025 Greater than 1,200 collection agencies were additionally checked, although the information ought to be acquired with a grain of salt, as Artsy freely specifies the term as any individual that has actually bought an art piece in the previous year. However, the record discovered that virtually 60% of collection agencies bought art online in 2024, with 73% of those claiming they bought the very same or even more of the collections contrasted to the previous year.

Amongst young collection agencies, i.e., on the internet buyers are a lot more typical: 71% buy online acquisitions, and 80% of them enhance or keep their on the internet costs for one year. Nevertheless, just 44% of galleries reveal rates for all offered tasks on their sites, while 25% still need prospective purchasers to “inquire” at rates.

The record highlights an acknowledged bottom line of self-service: Enthusiasts get art online even more than ever before, however numerous galleries still see the net as a display room and academic area, however not as a clear, trading market.

However also right here, the splits reveal. Almost fifty percent of collection agencies (46%) claimed they worth academic web content from galleries, whether it has to do with art background, innovation or market setting. Nevertheless, just 15% of galleries claim that such involvement rates the biggest amongst collection agencies’ experience.

Rate is still an additional factor of rubbing: 78% of collection agencies claim they are reluctant to get art due to the fact that it’s also costly on a spending plan. Over half (52%) have actually left due to the fact that they assume the task is also costly, while 32% are uncertain whether it deserves the asking cost. Still, the majority of galleries establish rates based upon the musician’s online reputation (75%), adhered to by dimension and tool (63%); just 45% mentioned market need. At the same time, collection agencies rely upon relative buying: 54% of individuals check out comparable jobs, while 41% speak with on public auction outcomes.

Gallery might additionally overstate the duty of geographical area. Many dealerships (57%) claimed they target global purchasers in 2025 and might intend to counter residential soft need. However, for collection agencies, area is still a discomfort: Just 16% claim their regional art market “totally” fulfills their requirements. This detach highlights an additional stress– alleries intend to broaden insurance coverage, however also in their very own cities, collection agencies commonly really feel underserved. Currently, the ordinary range in between purchasers and vendors on Artsy mores than 2500 miles, showing that the marketplace’s center of mass is significantly limitless, however additionally less people, and it’s hard to browse without clear advice.

For markets improved connections, interference is surprising. Many collection agencies inform Artsy that they value behind the curtain gos to and unique sneak peeks. The gallery concurred, however remained to concentrate on art fairs and typical exhibit versions that commonly offer existing customers as opposed to brand-new ones.

As public auctions lighten, sales at public auctions dropped 25% in 2024, with complete worldwide art sales dropping 12% to $57.5 billion – Guijinshe is rushing to improve its service. The record reveals that a market is embeded a change: understanding what is coming, however uncertain exactly how to please it.

Follow Me